The statement itemizes the cash and other deposits made into the checking account of the business, as well as any expenses paid by the business. This includes everything from wages and salaries paid to employees to business purchases like equipment and materials. Bank statements also show expenses that may not have been included in financial statements, such as bank fees for account services.

To detect bank errors

Note that Community Bank credits its liability account Customers’ Deposits (which includes the individual depositor’s checking account balance). As a result, Community Bank’s balance sheet will report an additional $10,000 in assets and an additional $10,000 in liabilities. When the bank debits a depositor’s checking account, the depositor’s checking account balance and the bank’s liability to the customer/depositor are decreased.

To detect fraud

To quickly identify and address errors, reconciling bank statements should be done by companies or individuals at least monthly. They also can be done as frequently as statements are generated, such as daily or weekly. Non-sufficient funds (NSF) checks are recorded as an adjusted book-balance line item on the bank reconciliation statement. There could be transactions unaccounted for in your personal financial records because of a bank adjustment. This may occur if you were subject to any fees, like a monthly maintenance fee or overdraft fee.

Comparing Accounting: Bank vs. Company

Each step of the reconciliation process should be clearly recorded, including any discrepancies found and the actions taken to resolve them. This practice not only aids in internal reviews but also provides an audit trail. Next, we look at how a bank uses debit and credit when referring to a company’s checking account transactions. If so, these entries will not appear in the bank reconciliation statement prepared at the end of the current month. The need and importance of a bank reconciliation statement are due to several factors.

To be effective, a bank reconciliation statement should include all transactions that impact a company’s financial accounts. Bank reconciliation is an important financial control process that helps ensure your financial records are accurate, and there are zero unexplained inconsistencies in your day-to-day transactions. Bank administrators process bank service fees, interest, and other bank transactions that you might not be aware of or not know the exact amounts of. A bank statement shows you those transactions and enables you to capture them in your records to reflect all the transactions affecting your business. The main reason a business should reconcile its bank statements is because you need to ensure your cash balance on the balance sheet is accurate. Regular bank reconciliations also help prevent fraudulent or unauthorized transactions from going unnoticed.

Compare every amount on the bank statement (or in the bank’s online information) with every amount in the company’s general ledger Cash account and note any differences. A liability account on the books of a company receiving cash in advance of delivering goods or services to the customer. The entry on the books of the company at the time the money is received in advance is a debit to Cash and a credit to Customer Deposits. The bank statement submitted by the businessman at the end of May will not contain an entry for the check, whereas the cash book will have the entry. As a result, a difference of $2,500 is caused between the two balances. Your books may not match the bank statements because the bank has added expenses.

For each of the adjustments shown on the Balance per BOOKS side of the bank reconciliation, a journal entry is required. Each journal entry will affect at least two accounts, one of which is the company’s general ledger Cash account. Ultimately, bank reconciliation is a relatively straightforward accounting process that is essential plain english accounting for understanding a company’s cash position. Companies that stay on top of bank reconciliation not only keep their accounts in check but can also strengthen their overall financial strategy. A deposit in transit is money that has been received and recorded in the cash book but has not yet been processed by the bank.

- Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions.

- Accounting for these delays is key to reconciling the total amounts on the company’s financial statement and the bank statement.

- Sometimes your current bank account balance is not a true representation of cash available to you, especially if you have transactions that have not settled yet.

- When preparing a bank reconciliation statement, a journal entry is prepared to account for fees deducted.

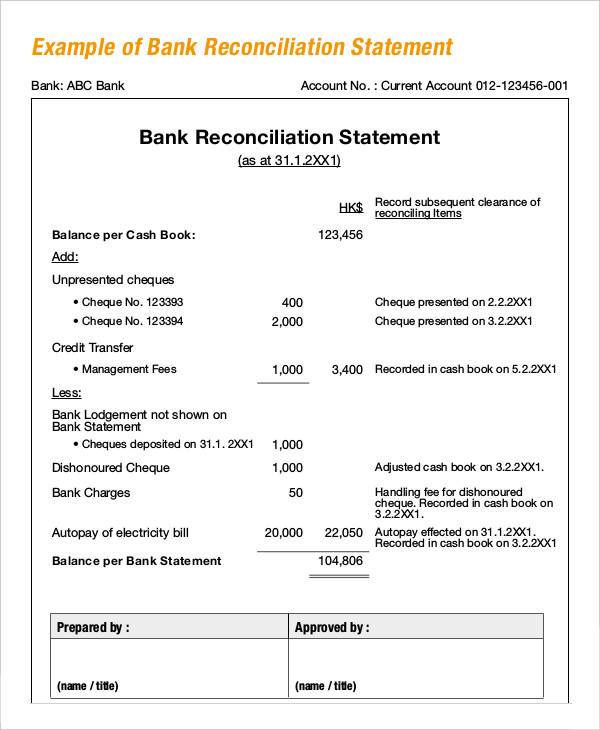

The accountant will also look to see if prior notification has been received and the event properly recorded. If an entry has not been recorded, the item will appear on the reconciliation. In the past, monthly reconciliations were the norm because banks used to issue paper statements on monthly basis. Prepare a bank reconciliation statement for Company A as of 30 September 20XX. Errors in calculation or recording of payments are more likely made by business staff than by a bank. Nevertheless, while bank errors are very rare, it is still a possibility.

By understanding and implementing bank reconciliation, you can keep polished financial records, detect any bookkeeping discrepancies, and ensure that your recorded cash balances are precise. A company prepares a bank reconciliation statement to compare the balance in its accounting records with its bank account balance. A bank reconciliation statement is a valuable internal tool that can affect tax and financial reporting and detect errors and intentional fraud. The information on your bank statement is the bank’s record of all transactions impacting the company’s bank account during the past month. Compare the ending balance of your accounting records to your bank statement to see if both cash balances match. In the absence of proper bank reconciliation, the cash balances in your bank accounts could be much lower than expected, which may result in bounced checks or overdraft fees.

If your bank account, credit card statements, and your bookkeeping don’t match up, you could end up spending money you don’t really have—or holding on to the money you could be investing in your business. This can also help you catch any bank service fees or interest income making sure your company’s cash balance is accurate. Infrequent reconciliations make it difficult to address problems with fraud or errors when they first arise, as the needed information may not be readily available.

Deposit in transit means the cash received from a party has been recorded by the depositor but has not been entered by the bank in the bank statement. After receiving a bank statement dated 31 December 20×1 for a checking account at First National Bank, the accountant for Sample Company began the reconciliation process. The bank statement is reconciled when the adjusted cash balance as per bank equals the adjusted cash balance as per company books. Since the adjustments to the balance per the BOOKS have not been recorded as of the date of the bank reconciliation, the company must record them in its general ledger accounts.

Comments are closed.