The frequency could be yearly, half-yearly, quarterly, monthly, weekly, daily, continuously, or not at all until maturity. Compound interest is contrasted with simple interest, where previously accumulated https://www.business-accounting.net/managerial-accounting-management-accounting/ interest is not added to the principal amount of the current period. Compounded interest depends on the simple interest rate applied and the frequency at which the interest is compounded.

Watch your balance double

When not working, she is probably paddle boarding, hopping on a flight or reading for her book club. Having worked in investment banking for over 20 years, I have turned my skills and experience to writing about all areas of personal finance. My aim is to help people develop the confidence and knowledge to take control of their own finances. The difference in fees makes a substantial difference to the value of your portfolio over time due to compounding of the returns and the fees, even though the difference may seem marginal. For compound interest, the interest is paid on the closing balance at the end of the previous year, which includes the interest paid in previous years.

Compounding basis

This powerful force allows someone to invest a sum of money today that will grow into a much larger amount. The force of interest is less than the annual effective interest rate, but more than the annual effective discount rate. Back to Albert EinsteinWith such potential for astronomical growth, it’s no wonder Albert Einstein called the power of compound interest the most powerful force in the universe. The problem though, is that there is substantial doubt he actually said that. QI hypothesizes that the statement was crafted by an unknown advertising copy writer. Over the years it has been reassigned to famous people to make the comment sound more impressive and to encourage individuals to open bank accounts or purchase interest-bearing securities.

Recommended Articles

And those 30 years were your working years when you had the choice of putting something aside for retirement. The impact of compounding on fees should also be considered as this can significantly erode the value of your portfolio. A third way to calculate compound interest is to create a macro function. The second way to calculate compound interest is to use a fixed formula.

The label “eight wonder” was applied to compound interest in an advertisement for a bank in 1925. No attribution was provided, and anonymous advertising copy writers have applied the “eight wonder” label to a wide variety of objects and ideas for more than two hundred years. QI has found no substantive evidence that Albert Einstein, Baron Rothschild, or John D. Rockefeller employed the saying. While Downey Jr. ended up winning an Academy Award for Best Supporting Actor for his work in the film, Conti’s performance as Einstein is one of the most powerful in Oppenheimer. The film is keen to note the legacy that Einstein is insistent that he must protect, as he fears that his research could fall into the wrong hands.

- Zero-coupon-bond issuers use the power of compounding to increase the value of the bond so it reaches its full price at maturity.

- Assets that have dividends, like dividend stocks or mutual funds, offer a one way for investors to take advantage of compound interest.

- Assuming that the same 5% APY is applied to your new balance, you’d end up with $1,105 after the second year.

- But if you have debt, compounding of the interest you owe can make it increasingly difficult to pay off.

Einstein’s appearance helps Oppenheimer reach its emotional ending, which certainly stands out from the more bombastic finales that Nolan delivered in such films as Tenet and Interstellar. Nolan certainly inserted some subtle political commentary in both Dunkirk and The Dark Knight trilogy, but Oppenheimer is most certain his most overtly political how do i calculate a prepayment penalty on a mortgage text to date. Considering the film’s record-breaking box office performance and Academy Award victories, it is safe to say that Nolan’s message reached a great number of people. While the film takes an occasionally dramatized approach to history, Oppenheimer accurately depicts Einstein’s fraught relationship with the United States military.

Earmarked for success at a young age, Einstein’s skills took him to several leading universities in the European educational network. After successfully securing Swiss citizenship in 1901, one year after graduating from the Swiss federal polytechnic school in Zürich, Einstein worked at the Swiss Patent Office in Bern. He would later move to Berlin in 1914 and become a German citizen, despite the growing chaos of World War I. Regardless of how much you make, the sooner you get started the better the 8th wonder of the world will start working for you—and a penny saved today could mean millions in retirement. So if you are telling yourself that you will put aside money for tomorrow “when you can afford to” or “when you make more money” or whatever, you are putting yourself at a huge disadvantage. Now, just for fun, imagine in the above example that each period represented a year instead of a day.

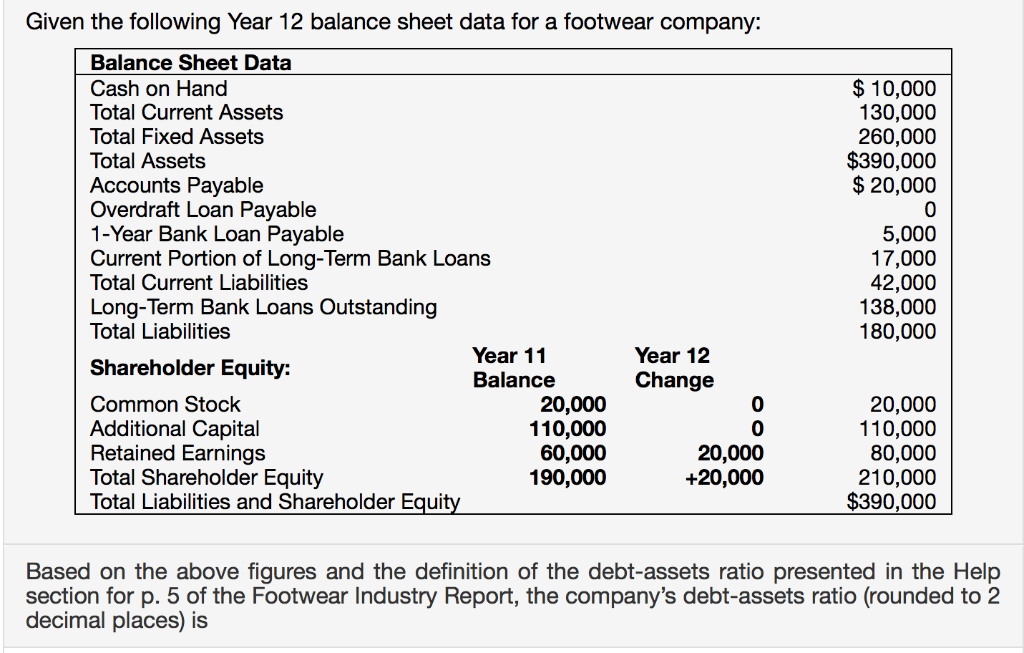

By the end of 10 years, the balance is £2,000 for the simple interest account compared to £2,594 for the compound interest account. This process differs from so-called ‘simple’ interest, which is when interest from previous years is ignored, and the calculation is https://www.kelleysbookkeeping.com/ made only with reference to the original amount. You should always check with the product provider to ensure that information provided is the most up to date. The first way to calculate compound interest is to multiply each year’s new balance by the interest rate.

Compound interest is interest accumulated from a principal sum and previously accumulated interest. It is the result of reinvesting or retaining interest that would otherwise be paid out, or of the accumulation of debts from a borrower. Allan S. Roth is the founder of Wealth Logic, an hourly based financial planning and investment advisory firm that advises clients with portfolios ranging from $10,000 to over $50 million. The author of How a Second Grader Beats Wall Street, Roth teaches investments and behavioral finance at the University of Denver and is a frequent speaker. He is required by law to note that his columns are not meant as specific investment advice, since any advice of that sort would need to take into account such things as each reader’s willingness and need to take risk.

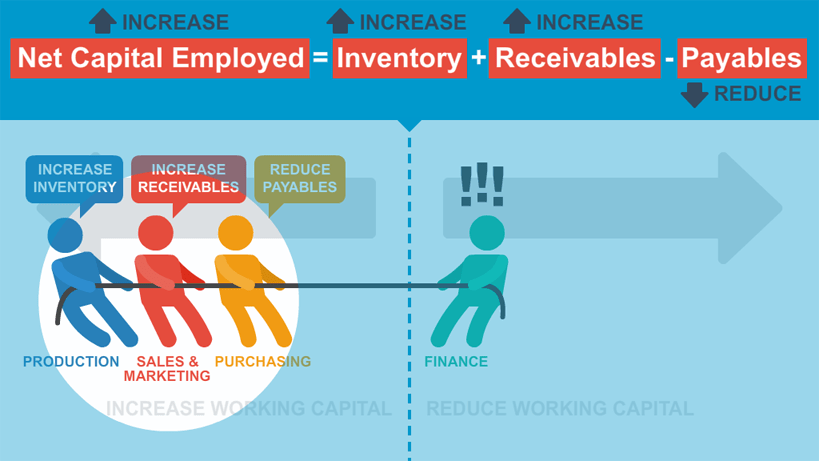

You can use a high-interest savings account to leverage the power of compound interest. Compound interest is calculated on the gross balance at the end of the year, which includes any interest accrued in previous years. In other words, as a saver or investor, you’re earning interest on the interest, or ‘compounding’ your returns. The long-term effect of compound interest on savings and investments is indeed powerful. Because it grows your money much faster than simple interest, compound interest is a central factor in increasing wealth. An investor opting for a brokerage account’s dividend reinvestment plan (DRIP) is essentially using the power of compounding in their investments.

You don’t need to set aside $100,000 to make noticeable gains with your savings. Albert Einstein famously referred to compound interest as “the eighth wonder of the world.” Anyone who understands compound interest, earns it. According to Einstein, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” At first this quote might seem like a bit of an exaggeration but the math behind it shows that it is not.

Comments are closed.