Companies are using blockchain to improve enterprise resource planning (ERP), especially in areas such as supplier management and procurement. Some even dabble in cybersecurity and sustainable database planning with the help of blockchain tech. Every new transaction is added to a new block, and then each new block is added to the system.

Auditable Records & Reports

There is already evidence to show how blockchain may reduce costs in the finance industry (e.g. Fanning and Centers, 2016; Kokina et al., 2017). As shown, all but one of the ten most-cited articles were published in ranked accounting journals. In fact, three were published in the Journal of Emerging Technologies in Accounting. Additionally, the topics cited match the topics revealed by the LDA analysis, particularly new challenges for auditors, opportunities and challenges of blockchain applications, and the regulation of cryptoassets. Two of the most widely discussed topics–“the changing role of accountants” and “the new challenges for auditors”–only seem to be getting more popular.

Corporate reporting

Blockchain Accounting demands a skilled workforce in technology, cryptography, and contracts. Overcoming the talent gap is vital, necessitating targeted training or hiring to handle Blockchain’s complexities. If an organisation tries to alter a transaction’s data in the Blockchain, https://www.adprun.net/ it will change the hash value. Smart Contracts can also enhance security and trust between clients and organisations by preventing fraud and scams. See how Integral can help you manage all of your financial data and operations in one place and scale your business with confidence.

processed monthly

Digital technology has long influenced accounting, but most digital technology has involved replacing analog tools with similar digital counterparts. However, blockchain, a relatively new technology, is poised to change how accounting is done on a more fundamental level. Here are some facts about the blockchain ecosystem and how it will influence accounting in 2021 and beyond. Being very promising, blockchain technology is still relatively young and immature.

Best Accounting Software for Trusts

Evernym, part of Avast, features its distributed ledger platform that lets individuals manage their identities all over the web. The company’s technologies verify user credentials and are built to be scalable and integrable to multiple types of back-end systems. Users can even store credentials on Evernym’s secure digital https://www.business-accounting.net/how-to-read-bond-tables-monthly-bond-yield-tables/ wallet, Connect.Me. Chainalysis helps financial institutions and governments monitor the exchange of cryptocurrencies and investigate blockchain activity. The company’s tools aim to detect fraudulent trading, laundering and compliance violations as well as gauge NFT security risk, all to build trust in blockchain.

Best Crypto Accounting Software include:

By supporting diverse lifestyles, your company can retain talented staff even when their circumstances change. Childcare, for example, becomes far easier, as do the frequent doctor’s appointments needed for many of those impacted by chronic illness or disabilities. This kind of change will transform the demands of our offices, our homes, our computer hardware, and the software tools accountants use to complete their tasks. The rise of automations and AI wizardry will have an impact on the skills that accountants need. Now that streamlining tools can handle the boring parts, employees will find the soft skills more important than ever.

For these reasons and more, the LDA method is currently one of the most commonly employed topic identification methods that does not simply rely on a static word frequency measure (Blei et al., 2003). Moreover, El-Haj et al. (2019, p. 292) recommend employing machine learning methods and high-quality manual analysis in conjunction as they “represent complementary approaches to analyzing financial discourse”. We followed this advice, applying a hybrid approach that comprised LDA analysis, citation analysis and a manual review. Even though, for most industries, blockchain is still a new and not yet well-established technology, the World Economic Forum estimates that, by 2025, at least 10% of global gross domestic product (GDP) will rely on blockchains.

- Finally, introducing blockchain will add more trust, security, and efficiency in accounting, auditing, and assurance.

- The following companies and government entities are a few examples of how blockchain applications are improving government.

- Each block on the chain contains a number of transactions that can be viewed and verified by everyone on the network.

- In addition, we employ a comprehensive editorial process that involves expert writers.

- This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations.

In 2018, the amount of electricity used to mine cryptocurrency can heat a home. On an aggregate basis, mining would represent the seventh largest country by electricity consumption. Inside each block header, the Merkle root represents a summary of all the transactions included in the block in the form of a hash. To create the Merkle root, hashes of two records are hashed together to produce a hash of the combination, and then the process is repeated moving up the tree until all the records in the block are represented in one hash.

The most representative articles are analysed in Section 5, with future research directions discussed in Section 6. Section 7 concludes the paper with the implications of this research for theory, practice and policy, along with the limitations of the study. INBLOCK issues Metacoin cryptocurrency, which is based on Hyperledger Fabric, to help make digital asset transactions faster, more convenient and safer. A public blockchain is one that anyone can join and participate in, such as Bitcoin.

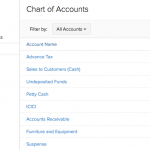

Accounting is known as the “language of business” as it classifies, analyses, and records all business transactions. QuickBooks Online Accountant offers powerful tools for accounting professionals. That makes this system ideal for publicly traded currencies such as Bitcoin, because it allows the statement of account for validation by the widest possible network of computers. The uncertainty linked to valuing cryptoassets is affecting the development of proper regulations, as this issue affects the fundamental qualitative aspects of financial accounting, such as relevance and faithful representation.

Comments are closed.